Businesses today need to rely on and maintain strong relationships with third parties to ensure successful operations. These third parties may include hardware and software vendors, raw material suppliers, staffing agencies, independent consultants, and contract-based employees.

As companies grow, they need to outsource resources — physical, intellectual, or virtual — to third parties. Although beneficial, even necessary, you need to ensure protection against any risks and protect your confidential company data from outsiders.

Third-party breaches are more complex to manage than other cyber attacks as businesses often give third parties voluntary, privileged access to their data for carrying out certain business functions.

As most prudent companies do, you must also put specific third-party risk management practices in place to ensure your data is secure at best while engaging with such outside vendors.

What is third-party risk management?

Third-party risk management refers to the process of discovering and managing risks that are associated with hiring third-party vendors or service providers. It is important, especially when these third parties have access to sensitive company information or intellectual property.

Businesses must exercise due diligence while selecting vendors and assessing their associated risks. They should also conduct regular checks to ensure the latter have robust security measures in place.

Types of third-party risks

There are five main types of risks that you must consider while evaluating third-party service providers.

- Cybersecurity risk: Probability of loss of company data resulting from a cyber-attack or data breach due to vendor vulnerabilities. This can be mitigated by scrutinizing the data security policies of potential vendors — whether hardware or software.

- Legal and compliance risk: The likelihood of a business facing legal penalties, lawsuits, or monetary forfeiture due to its failure to comply with industry-wide regulations and best practices. This risk is specifically applicable to technology, financial, government, and healthcare organizations.

- Financial risk: The possibility that a breach, disruption, or malfunction from a third-party vendor may impact the financial bottom line of your business. For instance, lost warranty contracts for faulty laptops from a hardware vendor can cost you thousands of dollars.

- Operational risk: The potential for disruption in internal business processes due to delays in the third-party systems. This type of risk can be reduced by defining service level agreements (SLAs) in contracts with your vendors.

- Strategic risk: The probability that you may not be able to accomplish your long-term company goals because of a third-party vendor.

What common challenges do CIOs face during third-party risk management?

While working to mitigate third-party risks, CIOs often face multiple challenges. Here are some of them.

- Barriers to security control: Not enough visibility into the security controls of hardware and software purchased from third-party vendors.

- Regulatory compliance issues: Not being able to assess and track whether your third parties comply with industry regulations.

- No solvency monitoring: No measure of determining how third-party solvency can impact your financial bottom line.

- Lack of resiliency management: No processes to support business continuity or incident response planning.

- Siloed, legacy systems: Legacy applications that are hard to integrate with each other result in disparate information, making the identification and control of operational risks more difficult.

- Lack of insightful audits: Most companies conduct audits but have no system in place to derive meaningful insights from them and make useful strategic decisions.

Adding to this, the lack of a single solution that can resolve all these risk management challenges is a bigger problem for most CIOs. Consequently, many fail at their attempts to mitigate third-party risks on all fronts.

Third-party risk management best practices

Below, we list a couple of best practices you can use for efficient third-party risk management.

1. Keep a third-party inventory

Document details of all the third-party vendors you interact with for carrying out essential business functions. You can classify these vendors by their importance. The importance of each vendor can be estimated in two ways:

- By determining the inherent risk i.e the probability of a data breach, business disruption, or financial solvency associated with each vendor.

- By assessing the impact the inherent risk of each vendor can have on your business and its financial or strategic performance.

2. Set a third-party risk management lifecycle

Setting a lifecycle for third-party risk management ensures that you carry out all the needed steps for each vendor.

It has three phases:

- Pre-contract risk assessment: Before you enter into a contract with a third-party vendor, ask yourself how critical are their services to your organization, will they need access to sensitive company data, will they have direct access to your customers or their data, or are they using any fourth parties i.e. subcontractors to provide you their services? You should also determine whether these residual risks are significant to ignore and if not, whether they can be mitigated.

- Contracting: While entering into a contract with your selected third-party vendor, consider the following provisions. Cover what happens in the case of business interruption or disaster, identify who would own the company data and what measures must be taken to recover it if needed, allow for vendor relief in case a vendor fails to perform as specified, and set information security policies that require the vendor to use your data only as mentioned. Furthermore, determine audit rights so you can test the vendor processes to see if they comply with industry regulations, establish agreed-upon expectations for service levels by vendors and set penalties for not meeting them, monitor the involvement of any fourth parties, and lastly, decide the actions that result in termination of the contract and how to successfully execute it.

- Post-contract monitoring: Continuously monitor the credit ratings, any new lawsuits, major layoffs, security and company policies, and financial statements of your vendors to determine the level of reputational, operational, and financial risk of working with them.

3. Automate the process

Try to automate the process where you can. For every phase of the third-party risk management process, use tools that can reduce the manual effort involved in risk assessment, contract management, and continuous monitoring of various risks associated with a third-party vendor.

Automation makes the process much faster and saves you both time, money, and human effort involved.

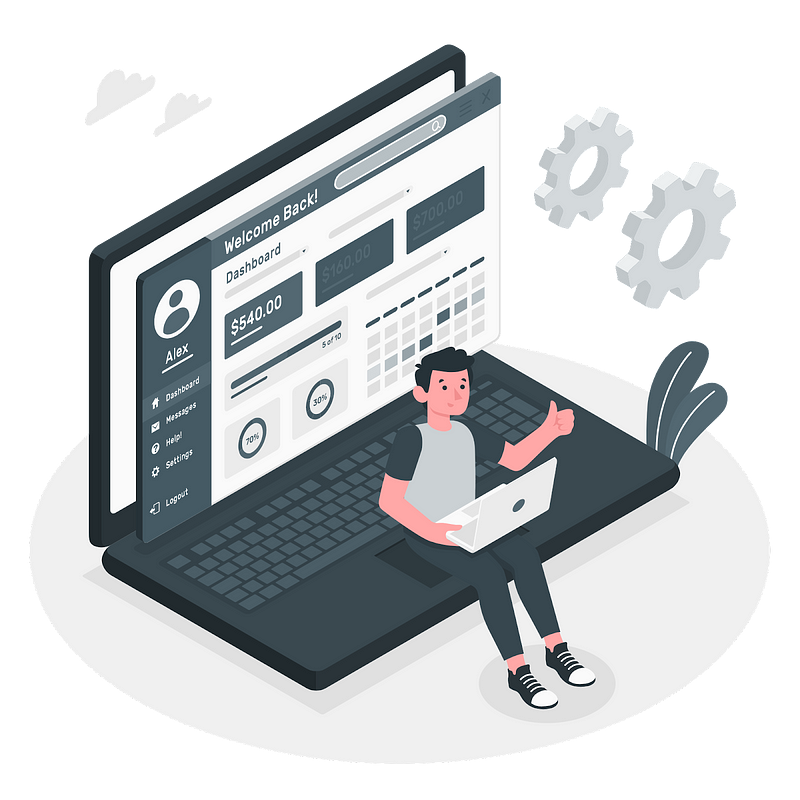

5 ways to meet your third-party risk management goals with an ITAM solution

An IT asset management solution comes equipped with different features that help you successfully manage third-party risks associated with your IT infrastructure — hardware, software, or network.

You can use an ITAM solution in five ways for efficient third-party risk management:

1. Security risk assessment

After you’ve purchased your hardware assets, inventory them into the ITAM solution using a discovery agent. The agent of an ITAM tool scans your laptops, computers, and mobile phones for security elements.

It checks whether anti-malware and antivirus software or firewalls are installed in your hardware. It also notifies you about the disk encryption status of your devices so the data can be protected from unauthorized users.

This helps mitigate the security risk associated with hardware purchased from third parties.

2. Software license management

As more and more employees use software applications to carry out key business functions, the threat of data breaches from software app usage increases.

With an ITAM solution in place, you can inventory all the software applications used by employees in your Active Directory. You can blacklist the use of high-risk software applications, run reports to see which employees use blacklisted applications, and take corrective actions as needed.

Similarly, you can keep a record of all licensed software applications. Track use of licensed and unlicensed software to optimize license purchase strategy.

Monitor license renewal dates and set automated alerts that notify you when software licenses are about to expire so you can always stay on top of your license compliance regulations with third-party service providers.

3. Vendor management

Maintain a list of all your third-party vendors with the vendor management module of ITAM software. You can record details such as the primary contact person for each vendor and tag the vendors based on their importance or risk level using custom fields.

Furthermore, run reports to identify which vendors you purchase most of your hardware and software assets from. This helps single out significant vendors and for seamless third-party risk management.

You can also run customized reports on high-risk vendors and determine how their financial or operational performance may impact your business goals.

4. Contract management

A key capability of IT asset management software is contract management. As you draft up contracts for each vendor, you can keep a centralized record of them in the ITAM solution.

Specify service-level agreements in the description of each contract. You can also attach PDFs of signed contracts and refer to them as needed. Keeping an official record of SLA contracts also helps minimize the operational risks associated with third-party service providers.

Furthermore, set alerts and get notified in advance if a contract is about to expire and needs renewal, get timely management approvals, and easily run reports to track the expense/costs associated with third-party contracts, thereby reducing compliance risk.

5. Dependency mapping

Most advanced IT asset management systems have CMDB functionality. Record, track, and edit relationships between IT assets such as computers, network devices, and software licenses against their vendors. This helps you get a consolidated view of third-party dependencies within your organization.

Identify high-risk vendors and monitor how dependencies of their hardware, software, or network assets ultimately impact the financial and strategic performance of your company.

To further corroborate your findings, you can run custom reports or dashboard KPIs specific to your business objectives. Proactive dependency mapping also helps restore operations to normal in cases of business discontinuity. It’s a valuable resource for making insightful decisions in terms of which vendors you should invest in for the long term.

Read more: 4 Efficient Solutions To Your Key IT Asset Management Challenges In 2022

About AssetSonar

AssetSonar is a powerful ITAM tool used by tech organizations and businesses all over the globe. Sign up today for a free 15-day trial.

For more assistance, drop us an email at support@ezo.io. You can also visit our blog for detailed support posts.

Join the Conversation: Twitter | Facebook | LinkedIn