Inventory is a vital business investment including both assets and consumable items depending on the nature of business. Regardless, maintaining an accurate inventory count is necessary to assess and record its true value in the financial statements. This is where inventory auditing comes in!

Inventory auditing is a critical process that shapes long-term inventory management and financial standing of a business. It helps maintain optimal stock levels and identify discrepancies in inventory to avoid excessive holding costs.

Let’s help you understand the basics of inventory auditing, its best practices, and how to expedite the auditing process using an inventory management system.

What is an inventory audit?

An inventory audit refers to matching a business’s actual inventory levels with its financial records to maintain transparency. Businesses can conduct physical checks to assess the accuracy of their records.

Inventory audits can be both internal and external – conducted by employees or third-party auditors. Either way, you can use an inventory management system to cross-check your records and flag items that are damaged, missed out or inaccurately listed. Inventory assessment helps ensure that your business is not over/ under spending on inventory and maintaining it in a cost-efficient manner.

Some tools used for inventory audits include barcode scanners, asset labels, inventory management software, mobile audit apps and custom reports.

Common challenges while conducting an inventory audit

Inventory is a major business investment that needs to be handled strategically. Smooth inventory management ensures complete visibility into the inventory landscape and helps develop inventory control.

Inventory auditing is a rigorous practice to maintain accurate stock levels and strategically conduct verification checks for accountability and transparency. While inventory auditing is crucial to maintain the integrity of business processes, it can still be challenging to execute.

Let’s discuss some of the major challenges faced by businesses while conducting inventory audits:

1. Technological hindrances

Lack of up-to-date technology to successfully execute audits slows down the process of auditing. This includes reliance on manual methods, like spreadsheets, for entering and cross-checking inventory data. These systems do not support real-time stock updates, advanced data analysis and procurement management.

Inability to manage vendor data from the same platform as inventory records can also limit a business’s capability to smoothly manage inventory. It makes it difficult to track the vendor of a specific inventory item, slowing down overall vendor tracking.

These limitations lead to data silos making it impossible to regularly update data – contributing to discrepancies in inventory records. With a business using different platforms for storing data, it can be difficult to extract (pick and choose) critical audit information and identify the most reliable data.

2. Inconsistent auditing practices

There is an increased risk of inconsistencies if audits are conducted without a defined criteria. Each auditor has their own way of scrutinizing the inventory which can lead to differences in outcomes – for instance, some might use the cycle count strategy while others might prefer physical counts. Cycle count involves auditing only a small portion of inventory which does not disrupt the operations as compared to physical count. This can contribute to inaccurate records and inconsistent documentation.

Additionally, without a clearly laid out procedure for auditing, auditors are free to use different auditing techniques every time, jeopardizing the reliability of the audit.

3. Inaccurate inventory count

Without an accurate inventory count, it can be challenging to conduct the audit in the first place. Inaccurate counts can be a result of various factors, like miscounts, misrecording and manual data entry. These factors can significantly impact the final count of inventory making it difficult to flag items that need special attention.

Damaged or unmaintained items that have not been recorded can also damage the integrity of audits. It can be difficult to point those items out, especially during last-minute audits. Likewise, if an item has been overlooked during physical counts, it goes unaccounted for – leading to gaps in audits.

4. Theft and fraud

Inventory that is in transit or in the warehouse is vulnerable to frequent theft. For instance, mischevious warehouse employees can report lower quantities of inventory received than procured. This means the actual inventory would be lower than recorded in the system, disrupting data analysis.

If the asset verification process is not well-defined, then it can be difficult to track down the actual owner of the asset. Staff may fail to inquire the rightful owner of the items about misplacement or theft. In this way, incorrect or missed ownership leads to inaccurate financial records.

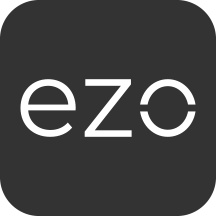

6 Top Inventory Audit Procedures

Businesses employ a variety of audit procedures to verify the count and condition of their inventory better. Effective audit procedures help businesses analyze inaccuracies and gaps in their inventory on time and take corrective action. The aim of these procedures is to ensure robust inventory tracking, and also forecast the future inventory needs based on the current trends.

Here are some major inventory audit procedures businesses can adopt for streamlined auditing:

1. Physical counts

Physical counts may seem like an old-school technique, but most businesses prefer using it to validate the quantity of their inventory items. The primary goal of physical count is to match the inventory count in the system with the actual count. The process involves following a few basic steps, including

- Planning: Deciding the aim of the audit and choosing a suitable time to conduct the audit.

- Organizing inventory: Label inventory items with QR codes or barcodes and scan them at the time of check in/out to manage the inflow and outflow of inventory.

- Conducting the count: Divide the inventory into sections that need to be audited and use scanners or asset registers to record quantities.

- Reporting: Conduct data analysis by representing the numbers and highlighting discrepancies that need adjustment.

Following these steps ensures that you can improve the usability of inventory items, and overall resource allocation.

2. Random sampling

Random sampling is a rapidly used technique than inventory counts. It includes assessing a small sample of inventory items against their records to determine their reliability. This is a faster and efficient process as compared to physical counts as it enables businesses to avoid the hassle of checking each inventory item separately.

The technique involves dividing the inventory into categories, using statistical methods to select an appropriate sample size, and ensuring that the sample is representative of the majority of inventory segments. You can run audits on the selected items and also tag the counted items simultaneously to avoid double counting.

It enables businesses to save both time and resources required for the audit and achieve maximum inventory accuracy.

3. Cut off analysis

The cut off analysis practice refers to halting the operations related to inventory procurement and check outs to record the exact count. This helps ensure that inventory items used or procured in a specific accounting period are counted to avoid over or under counting.

With this technique, auditors can reflect the true value of inventory in the system. Although halting operations temporarily can be disruptive for businesses, it can greatly help them assess the exact inventory value while conducting regular audits or reviews.

4. Overhead analysis

Overhead analysis in inventory management refers to assessing the costs associated with handling inventory, like holding, labor and insurance costs. Accounting for overhead costs enables businesses to account for all expenses incurred on using inventory items. For instance, staff can record maintenance costs associated with the upkeep of a backup item to keep a trail of all expenses.

Analyzing these costs also helps managers calculate the exact expense incurred on maintaining the inventory and eventually optimize operations. This enables them to establish a stronger inventory control process to minimize the costs and utilize resources efficiently.

5. Identifying obsolete items

Timely identification of obsolete inventory helps avoid hefty holding and carrying costs associated with inventory. It includes conducting a thorough inventory check to assess what items have gone obsolete and can no longer serve their intended purpose. You can easily identify obsolete items through frequent depreciation checks, and assessing the item technology and usage.

Obsolete items overestimate inventory value – leading to unreliable audit results. It makes it difficult for warehouse managers to make informed financial decisions regarding inventory usage. It can also lead to wrong inventory allocation as there would be more inventory on records than actually available to get the job done – disrupting asset inventory management.

6. Barcode labeling

Barcode tagging is an essential inventory management practice that eases the processes of auditing. It makes it convenient for warehouse managers to identify each item and scan them at the time of reservations, and check ins or check outs.

Managers can produce customized barcode labels to encode essential inventory information, like item name, identification number, location, cost, and owner. Each barcode can be unique to cater to a specific type of inventory item so the items are not mixed up while organizing them in the warehouse.

Auditors can simply scan the barcode at the time of audit to conduct verification checks. Barcode tracking during audits reduces the chances of human error in recording inventory details, and enables users to automatically retrieve data without auditors having to check the records themselves. This way, large quantities of information can be easily accessed with just a scan!

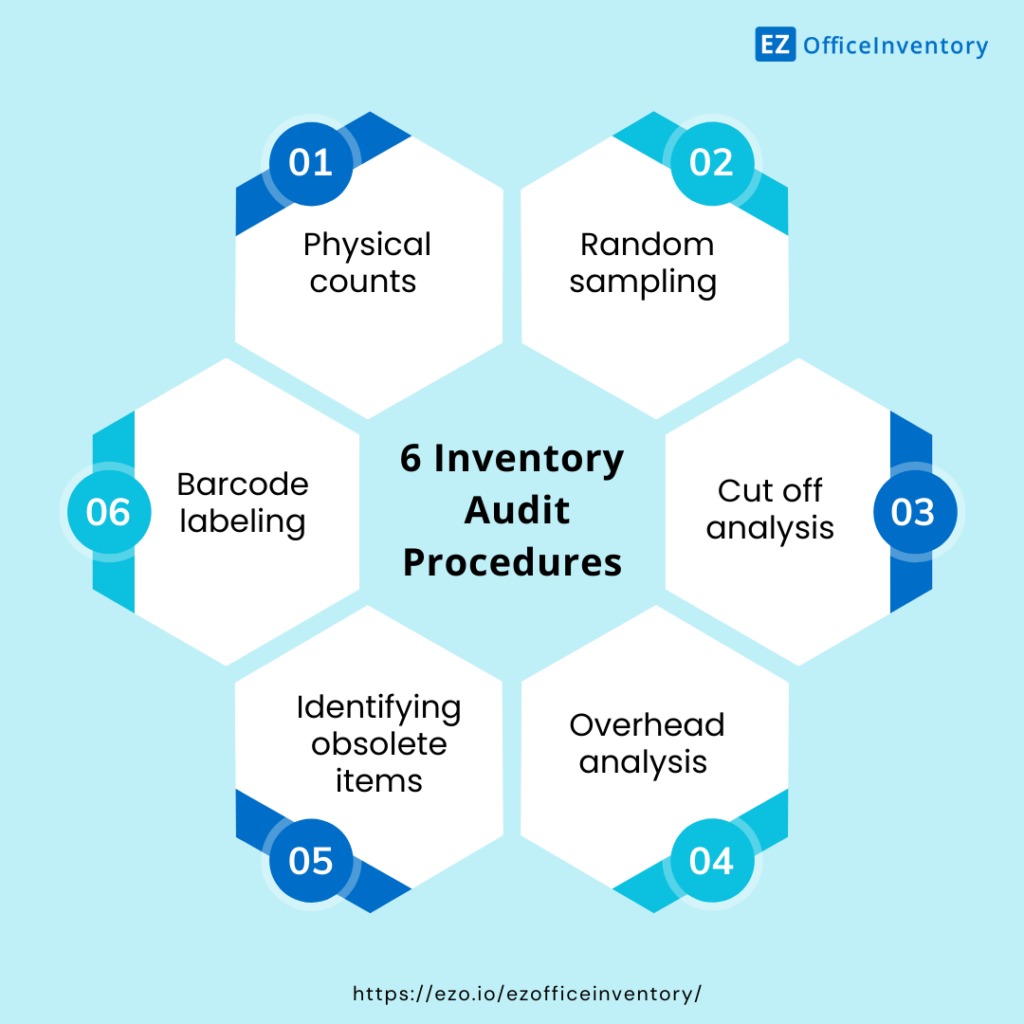

Inventory audit checklist

Although the process of inventory audit varies with every business, there are a few basic aspects that every auditor should cater for a successful audit. As per a report, $1.1 trillion is tied up in inventory – highlighting the criticality of adopting wise inventory management techniques to avoid excessive costs. Creating an inventory audit checklist is one of the several techniques that can streamline your auditing efforts.

Here’s a sample checklist:

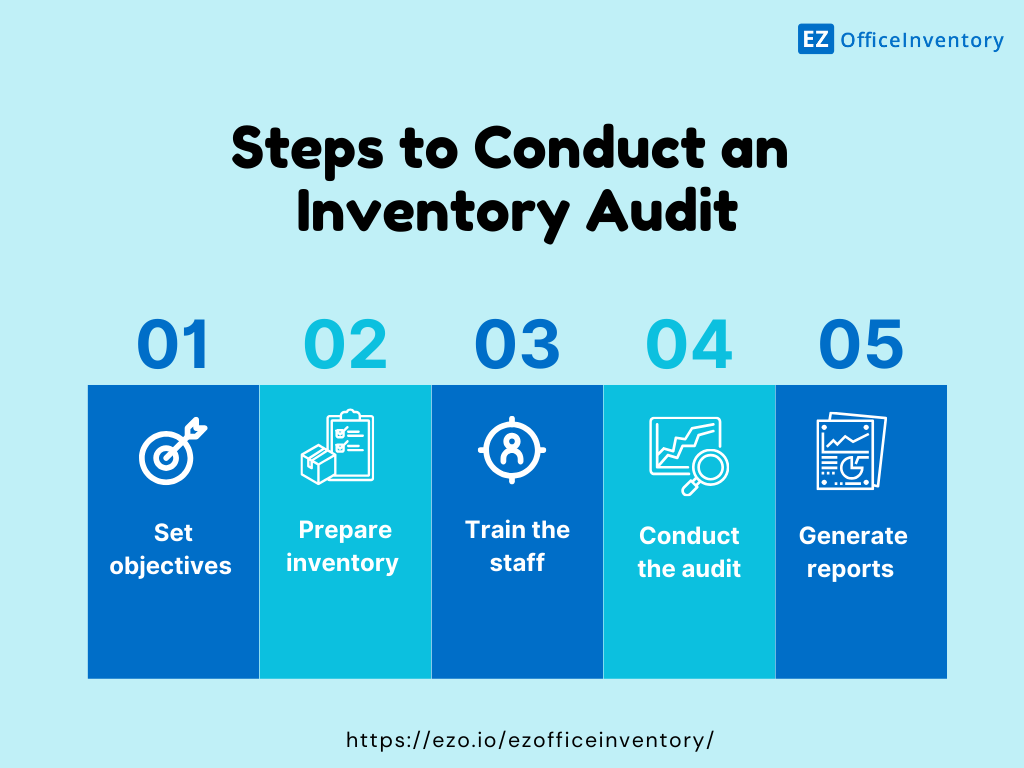

Steps to conduct an inventory audit

Conducting inventory audits is an intricate task requiring careful cross-matching of inventory records and financial statements. Planning for the audit in advance saves your business time and chances of last minute delays and errors.

Here are some best practices for successfully conducting an inventory audit using an inventory tracking software:

1. Set objectives

Setting clear objectives for your audit helps direct the auditing efforts and achieve them in a timely manner. This practice enables asset managers to prioritize tasks and keep the audit focused. For instance, if the aim of the audit is to flag unused inventory items, then the auditors can use the ABC analysis technique for inventory categorization and highlighting items that are not aligned with the expected usage.

Based on the objectives, you can create an inventory audit plan to structure the process. In light of the plan, auditors can avoid gaps and errors while conducting the audit and better monitor inventory. Standardizing the inventory protocols enables auditors to achieve consistency in results.

2. Prepare inventory

After you have set the objectives, it is wise to choose the inventory that needs to be audited. This includes categorizing the items beforehand and labeling them accordingly so auditors do not waste time looking for the relevant items. In case you have not audited your inventory in a while, you might want to run detailed checks on all items! First assess if it’s a regular, recurring or special audit to decide on the type of inventory that needs to be audited.

Proper warehouse management is a part of this process! Make sure that your warehouse is not cluttered and high-value items are stacked next to each other to avoid difficulties in finding the items while scanning during audits. An organized warehouse will make it easier for the auditor to ensure that all items have been counted.

3. Train the staff

If you are conducting the audit internally, then it is advisable to provide proper training to your staff to avoid unexpected errors and gaps in audits. Training includes making the staff familiar with the rules and procedures of the stock audit, and giving them a demonstration of the inventory management system being used. Staff can be walked through the modules to understand how items are to be flagged using the system.

Hands-on practice sessions can be provided to reiterate the system’s functionalities. Staff can be assessed through mock audits as well to ensure effective audits.

4. Conduct the audit

After training the staff, you can conduct the audit using your inventory management system. The system enables auditors to audit the inventory location wise. So, if you choose to assess inventory items located in certain locations or different warehouses, you can simply choose those locations in the system. The system will provide value of the total inventory, verified and flagged inventory based on your selection. This way, you will get a comprehensive overview of the value of inventory that needs immediate attention.

You can verify the quantity of each inventory item in the system using scans. If the physical records do not match the inventory records in the system then mark them for further assessment.

Additionally, you can conduct custody verifications to ensure that the relevant warehouse managers have been assigned inventory items. They can verify, using the system, the quantity of each inventory item and its availability or state for increased visibility.

5. Generate reports

After conducting the audit, generate a detailed report highlighting the audit findings. For instance, the total number of inventory items that have been flagged, denied or need further assessment will be highlighted. An audit report will provide a summary of the items audited, and the associated results – like three monitors at the New York Office were marked verified by Smith Adams (the auditor) on 29th April 2024.

Reports make the interpretation of the results easier. These reports can be used for compliance purposes to justify proper utilization of inventory. Compliance can make or break the auditing process – reports help ensure compliance with internal controls and make it easier to attain higher management’s approval.

Achieve efficiency with well-structured inventory audits

Inventory audits are a vital part of business operations. Without them, businesses would fail to account for inventory and maintain optimal stock levels. According to AICPA Auditing Standards, auditors are to report the exact quantity and condition of inventory if inventory is a vital component of a business’s financial statements. Audits using modern-day inventory management systems help ensure just that!

Such systems come equipped with advanced capabilities that enable auditors to seamlessly manage the entire audit process – from counting inventory to analyzing audit results. Businesses can maintain accountability and stay compliant while controlling and tracking inventory at the same time.