Insurance – A Business strategy to deal with uncertainty

A wise organizational management structure involves taking into account all risks. In order to do this, the smart move would be to consider getting insurance for your company. Planning to get an insurance is not an easy task. If you want any damages to be reimbursed, you need to keep your asset data updated at all times. Insurance not only protects companies against unforeseen circumstances but ensures legal compatibility as well. It is often the requirement of the government that businesses must possess certain types of insurance policies. To meet this criterion and to offer a safe working environment for your employees, it is impertinent that you save for insurance.

Besides attaining legal compliance, your business possesses valuable assets which cannot be compromised in any case. To safeguard your assets from unauthorized activities, insurance against data breach is highly suggested. Following this trend, the principal small business market is predicted to grow from $58 Billion in 2013 to $63 Billion in 2018.

In a competitive marketplace, companies are susceptible to various malpractices and often end up paying high costs. All this can be easily avoided if you streamline insurance processes for your company. You can start off by investing in an efficient and easy-to-use asset tracking solution. A cloud-based software such as this, allows you to record all asset movements, all the time. This comes in handy in case of unexpected breakdowns where insurance is required. Let’s look at some ways you can improve your business’s insurance processes:

1. Uphold business credibility through routine audit reports

Every year your company adds many new assets to its portfolio and disposes of a few. These similar assets are then used extensively by your employees. Two things should be noted in such situations. First, how your inventory has evolved over time and second, who is using that inventory. All this information comes in handy when you try to generate insurance claims. If your organization carries out transparent asset tracking procedures, dealing with unexpected malpractices becomes easier.

Say in case, your firm suffers from a natural disaster. You could’ve easily claimed for insurance if your company kept a record of asset utilization. With the help of asset tracking software, you can record every instance of tool ownership and possession whenever you conduct audits. This feature lets you update the condition of your tools and machines as well as monitor checkpoints in an asset’s lifecycle. With a detailed database of your inventory, insurance procedures can be carried out seamlessly.

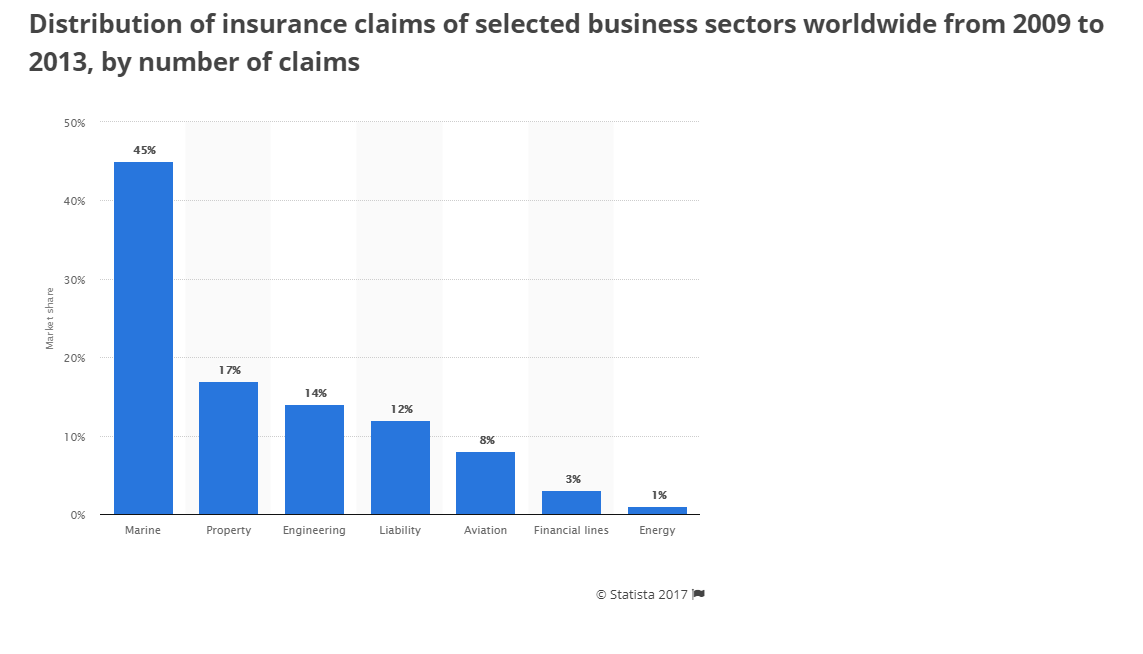

Did you know? The Marine business sector has the highest insurance claims amongst all other sectors.

2. Tag all your assets to maintain secure online documentation

For businesses on the move, asset tracking is a tough task. In addition to work operations, you have to manage small tools and instruments as well. For institutions like hospitals where small inventory items are regularly used, keeping a systematic database becomes mandatory. Doing this allows you to record each and every movement in and across locations. This is where barcode technology comes in. Barcode tracking software lets you design QR labels for all your inventory items. When your assets can be easily scanned in a system, you can update information faster.

One big advantage of having barcode tracking is that you can maintain a record of asset movements at all times. A secure online database provides you an edge when it comes to filing insurance for stolen or misplaced assets. Even if your paper-based asset records get stolen or misplaced, you will still have access to the online documentation. A cloud-based system protects your data against malpractices and unauthorized usage. This way your asset records are never compromised, even under unfortunate circumstances. This allows you to be well prepared for unforeseen situations which call for insurance.

Read more: The beginner’s guide to barcode management software

3. Organize maintenance sessions to claim for breakdown coverage

As a small and medium business owner, you tread upon your finances very carefully. While this is a good practice, there are however some situations you cannot avoid. Such events refer to unexplained equipment breakdowns during work operations. Oftentimes, the damage is serious and the company cannot afford to fix it given the tight budgets. This where your insurance claims come in handy. If your business records all maintenance sessions with a sophisticated software, it won’t be difficult to get security for your broken tools.

For this very purpose, asset tracking software allows you to hold maintenance sessions. By using this service, you can store all relevant maintenance reports of an asset. In case of an accidental breakdown, you will be eligible to file for insurance. With all the past service sessions information, you can accurately judge the damage and ask for the required security.

4. Track depreciation for accurate security estimates

All items in your inventory come with a useful lifespan. After this period, the smart decision would be to get rid of old assets. For this reason, tools and machines require special attention when it comes to depreciation management. Apart from lowering overhead costs, tracking depreciation allows you to come up with an estimate of the monetary value of an asset. Why do you need to do this? When you claim for insurance about a lost or stolen asset, you need to provide proof of its worth at the current time period.

You can do this simply through the use of asset tracking software. With depreciation tracking enabled for all your inventory items, you know exactly how much they are worth. You won’t have to go through the hassle of last-minute incorrect estimations, whenever your equipment gets stolen. Having access to quality devaluation reports lets you streamline insurance processes for your assets.

Read more: Leverage your assets for maximum value using equipment tracking software

Manage insurance processes efficiently through asset tracking software

Business insurance is a crucial practice which should be devised in an appropriate manner. In order to do this, firms need access to quality data about assets and inventory items. The absence of such data makes it difficult to prove the claim for the accurate security amount. To avoid last minute inconveniences, it always helps to maintain a robust database covering all asset movements. You can do all this with the help of an asset tracking software.

Tag your tools to enter valuable information online and accurately estimate insurance for malfunctioned equipment. Get started today to create a safer future for your business.

Share queries on asset tracking software

EZOfficeInventory is a sophisticated asset tracking software, popular among numerous companies and small businesses. It allows them to carry out streamlined asset management for improved insurance processes.

For more assistance, drop us an email at support@ezo.io.